Government data shows 40% of pension transfer amber warnings are for unknown reasons, making it hard to understand whether the system is working.

Quilter is calling for clarity around the government’s new pension transfer rules after finding 40% are flagged and delayed by trustees for unknown reasons.

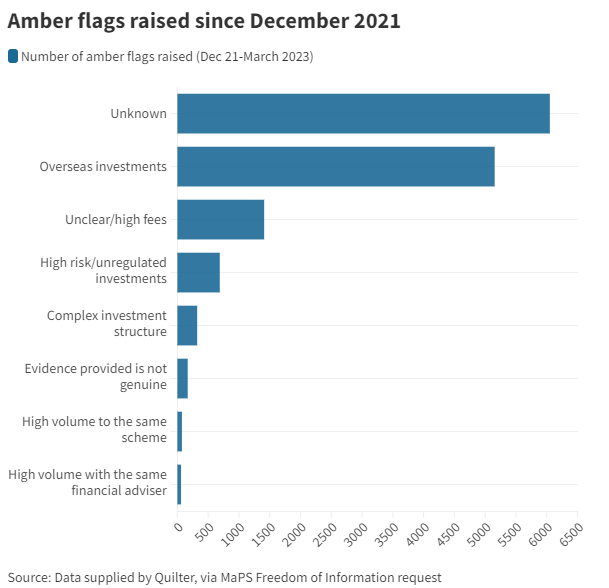

According to freedom of information (FOI) data obtained by Quilter, 6,050 (43%) of amber flags raised by trustees were for ‘unknown reasons’ over the past 18 months (see chart below). If an amber flag is raised, the member will have to obtain scam guidance from the government’s Money and Pension Service (MaPS), which can delay a transfer.

The government introduced the new pension transfer warning rules in November 2021. They require pension trustees to raise a red or amber flag if they have concerns about a member moving their pension.

Some have criticised the new rules, which were designed to stop scams, for unnecessarily delaying pension transfers to mainstream products and providers.

Jon Greer, head of retirement policy at Quilter, said the lack of clarity around these ‘unknown’ amber flags makes it difficult to scrutinise the effectiveness of the pension transfer rules.

‘The high percentage of “unknowns” in the last 18 months amount to ineffective data collection, which leaves a real gap in our understanding of how effective the rules have been,’ he said. ‘This gap also highlights the potential for increased customer disengagement and frustration if they are not clear on the reason as to why their pension transfer has been delayed.’

After the unknowns, overseas investment attracted the largest number of amber flags, making up 37% of all transfer delays, according to the FOI.

As Citywire New Model Adviser reported last year, ambiguous rule wording means overseas investments can cover mainstream open-ended funds from major global asset managers as well as unregulated offshore investments.

‘The current drafting makes no distinction between overseas investments that prevent a scam risk as opposed to those that do not, and at present there is a clear divergence between policy intention and the practical application of the law,’ Greer said.

Nathan Fryer, director of outsourced paraplanner Plan Works, said the rules create a lot more client paperwork, which means members often just ‘sign where they are told to sign’.

He added that pension providers are now being very cautious over transfers because they do not want to be caught out over due diligence failings, particularly on unregulated investments, which the regulator has focused on in recent years. But as the data above shows, just 689 flags have been raised over high-risk investments and 322 over complex investment structures since the rules were introduced.

DWP review

Ahead of an imminent Department for Work and Pensions review, Quilter is calling for the government to provide clarity over what should be defined as an ‘overseas investment’ when it comes to the flag rules.

The provider is also asking the government to force pension schemes to provide clear information to members about why an amber flag has been raised to stop the high number of unknowns.

In addition, Quilter wants more resources for MaPS so members can get appointments quicker. Some people are having to wait more than a month to get a government guidance session, Quilter said.

Alicja Hagopian (Citywire)