After a lifetime accumulating pension savings, you reach the point when those savings must provide a regular income for your retirement. Recently the options have become much broader, but the most traditional route – the annuity – is refusing to go quietly. Here’s why.

Consider your pension fund, built up over a working lifetime. On retirement, you could simply draw a regular amount (monthly, quarterly or yearly) directly from the fund. The problem with that is, if your withdrawals outpace capital growth then over time your fund will be eroded, and eventually exhausted.

This, in a nutshell, is why annuities exist. An annuity is a kind of insurance policy against the two key risks of retirement: living longer than the average person, and not generating sufficient investment returns to sustain your regular income. So you can use your pension fund to buy a secure lifetime income from an insurance company. If you die younger than the average then the insurance company benefits, and if you live longer then you do. If you live to average age, it’s break-even.

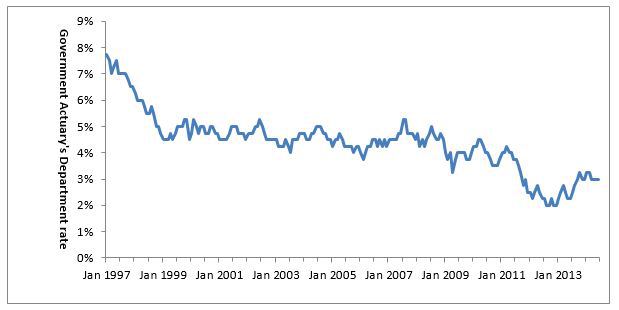

However, over the past ten years pension annuity rates have fallen by about 50%, in line with the fall in global long-term interest rates and improving life expectancy. This means, for example, that a 65 year old man with a £100,000 pension fund can today obtain a guaranteed annuity with a secure level income of about £5,500pa, compared to about £10,000pa in 1997. This massive fall in the pay-out of traditional annuities has seen their popularity decline.

Historic annuity rates

Source: Scottish Life from Government Actuary’s Department tables

Contrary to what you may have heard, buying an annuity has not been compulsory for many years. However, the rules relating to who may take regular withdrawals directly from the fund (known as pension drawdown) mean that, in practice, only people with larger pension funds have been able to take advantage of this option.

Another detrimental factor has been that many people tended to end up with the annuity income which their existing pension provider offered. In many cases, this was much lower than they could have obtained by shopping around.

Partly in response to the perception that traditional annuities are poor value for money, from 6th April 2015 anyone will be allowed to take up to 100% of their pension savings as a lump sum. In most cases up to 25% of the lump sum will be free of tax, while the balance will be taxed at the individual’s marginal income tax rate.

Such flexibility may be useful for some people, but for others it might lead to making poor decisions result in bad financial outcomes. The fact is that most people will live much longer than they think, and life expectancy is likely to increase even more. And although this in turn is likely to lead to further falls in annuity rates, a guaranteed income from an annuity can still be the right long-term choice in a number of scenarios. Let’s look at them one by one.

A secure base

By using a proportion of your pension fund to buy an annuity which meets some or all of your basic living costs, you can then make regular or ad hoc withdrawals from the remaining pension fund over time to fund additional ‘extras’. This strikes a balance between security and flexibility.

A gradual approach

You can use your pension fund to buy a series of guaranteed annuities over time, known as phased retirement. If you take the maximum tax-free lump sum each time you use a proportion of the fund for annuity purchase, this can be used (together with the annuity income) to fund that year’s living costs. The remaining pension fund remains available for continued investment growth until needed for further annuity purchases. Because annuity rates rise as you age, subsequent annuity purchases secure a higher level of income. The cumulative annuity income rises over time until the entire fund has been used to buy annuities.

Impaired health

If you have a health condition which is severe or terminal, then buying an annuity is not likely to be best value for your family (since you expect to die sooner than average). If however, you have one or more of a wide range of long-term common health conditions, you can obtain a higher annuity than the standard rate. These are known as enhanced annuities, and a leading provider estimates that the average increase is in the region of 20%. Qualifying conditions include smoking, alcohol consumption, heart disease, stroke, cancer, diabetes, raised cholesterol, hypertension (high blood pressure) and being overweight. Click here to find out how much higher an annuity rate you might be able to secure.

Cash investor

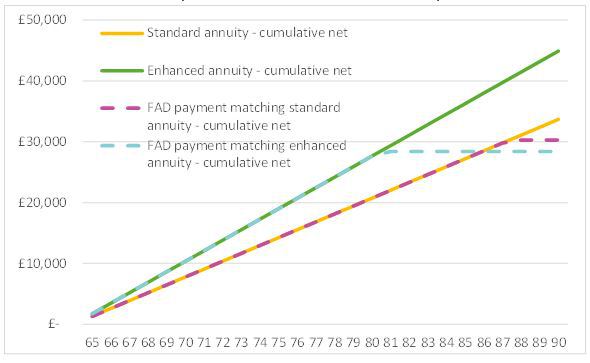

Whether you take a regular or single withdrawal from your pension plan, you will still need to generate an income from that capital. If you intend to hold the withdrawn funds in a deposit account, a standard or enhanced annuity may provide a much higher and more stable total return over the long term. The chart below illustrates the cumulative cashflow received by a basic rate taxpayer from a standard and enhanced annuity purchased with a £30,000 pension fund, compared to that from taking it as a taxable lump sum and investing it in a deposit account, with an assumed interest rate of 2.5% before tax.

The total cashflows received from the annuity exceed the savings account capital and interest after about 15 years for an enhanced annuity, and 22 years for a standard annuity. If the pension fund is larger (or your other income is higher) and as such incurs 40% and/or 45% income tax on the lump sum withdrawal, then the breakeven point at which the standard and enhanced annuity would be better falls to 11 and 16 years respectively. In both cases, the annuity income continues throughout life, whereas the deposit account capital is extinguished.

And finally… simplicity

An annuity (or a series of annuities) is easy to arrange, does not need on going advice or management, and avoids on going costs. Do you want to be making complex decisions about funding your living costs when you are in your 70s, 80s or 90s, or would you prefer the ease of a regular and secure income? Although at first glance there may be a range of attractive alternatives, none of them offers the simplicity and security of a guaranteed annuity for what is likely to be a very long retirement.