Chancellor decides to keep triple lock in place.

The state pension is set to rise by 8.5% from April 2024, as chancellor Jeremy Hunt confirmed the triple lock remains in place in today’s Autumn Statement.

‘We honour our commitments to the triple lock in full,’ said Hunt.

In the run-up to the Autumn Statement, there were reports that the government would use a lower measure of earnings when it sets the state pension next year. However, that has not happened.

In real terms, the full new state pension will increase from £203.85 per week to £221.20. This will be an increase of more than £900 per year, to £11,502.40 per year.

For those who reached state pension age before 2016, the basic state pension per week will increase from £156.20 to £169.50, to £8,814 per year.

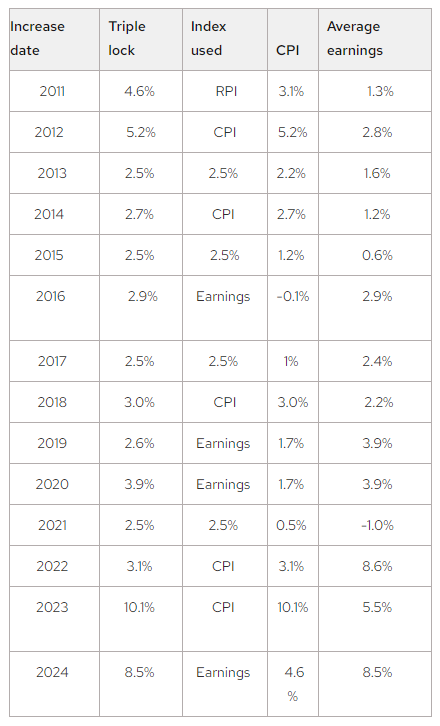

His 8.5% increase marks the second-largest state pension increase since the triple lock was introduced in 2011, with last year’s 10.1% increase leading the way.

This figure is slightly higher than the 8% increase expected in September of this year.

The rise will cost the government around £7.6bn a year, according to platform Nucleus.

Hunt cited the triple lock as a ‘lifeline for many during a period of high inflation’.

The triple lock mechanism ensures that the state pension will increase by the highest out of average earnings growth, consumer prices inflation, or 2.5%.

Many industry experts still maintain scepticism over the long-term viability of the triple lock, despite its immediate benefits for pensioners.

‘The large increase in the state pension from April 2024 will be a welcome boost to the many people who are struggling given the current cost of living crisis,’ said Nucleus technical services director Andrew Tully. ‘The last couple of years has taken its toll on finances, with many having to make difficult choices to make ends meet.

‘It is widely agreed that the triple lock is not sustainable over the long term. Rather than focus solely on the triple lock, we need to consider the future of our state pension system as a whole. This wider debate should consider a suitable level of state benefit, state pension ages, differing life expectancy across the UK, and support for those below state pension age who aren’t able to work. ‘

Alicja Hagopian (CityWire)