Core inflation at 6.1%

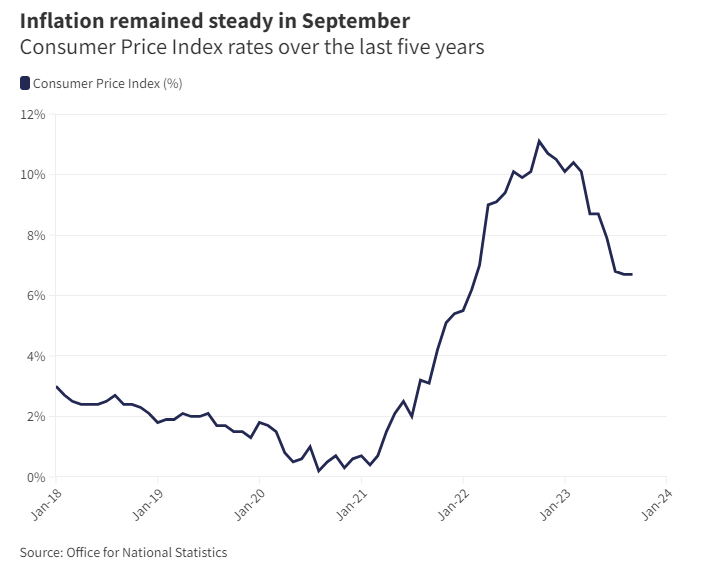

UK inflation has remained steady as prices rose 6.7% year-on-year in September, matching the previous month’s figure, the lowest rate since March 2022.

The Office for National Statistics said today (18 September) that prices had risen by 0.5% between August and September, matching market expectations.

Core inflation, which excludes energy, food, alcohol and tobacco, saw a slight annual decline, rising by 6.1% over the last year compared to 6.2% in August.

The largest downward contributor to inflation was a drop in prices in food and beverages, which fell for the first time since September 2021, as well as furniture and household goods.

This fall was offset by rising transport costs, driven almost entirely by petrol prices, which jumped 5.1 pence per litre between August and September.

Marcus Brookes, CIO at Quilter Investors, described the path back to target for inflation as ‘slow and steady’, but noted that UK inflation remained “incredibly elevated and much more so than peers”. In contrast, US inflation sat at 3.7% last month.

He added: “With geopolitical tensions rising, energy and petrol prices are once again on the way up and inflationary pressures risk hitting an economy that has gone through a painful cost of living crisis.”

The numbers left the Bank of England in a “difficult position”, Brookes said, following its decision to hold interest rates at its last Monetary Policy Committee meeting.

“The question becomes when they have done enough, but with inflation taking so long to come back down to more palatable levels that is a difficult question to answer and risks policy misstep,” he said.

“We think the Bank of England has done enough and will be led by external factors, such as the Federal Reserve, but they will not want to appear to be doing nothing, especially when inflation remains so high.”

Prior to the release of the inflation numbers, swap markets indicated a 50% chance of a rate hike at the MPC’s next meeting, noted Chris Arcari, head of capital markets at Hymans Robertson.

“However, attention is increasingly shifting from how far rates will be raised, to how long they will remain at current levels,” he explained.

While the central bank may ‘look through’ a temporary spike in fuel prices, Arcari argued the risk of second-round effects, alongside sticky core inflation and tight labour markets, “are reasons why central banks may proceed cautiously with rate cuts”.

Emma Mogford, fund manager on the Premier Miton Monthly Income fund, added: “Inflation was stubbornly high in September despite the rapid increase in interest rates over the last year.

“The Bank of England will nonetheless continue to wait to see more of the lagged effect of its current policy, rather than increase rates, but the decision hangs in the balance.”

Elliot Gulliver-Needham (Investment Week)