There is still a high propensity to seek an adviser in the future

Nearly half (44%) of people who do not use a financial adviser have said that it is due to a lack of understanding of what they can offer them.

This is according to the Intergenerational Wealth Report 2023 conducted by TIME Investments in January 2023 among 500 people – 250 of them aged between 18 and 26 and 250 aged between 27 to 42 all with annual incomes of £50,000 and above.

Of the 44% who do not already use an adviser, the study found that some of the reason include perceiving them as “too expensive” and/or they have decided that they will manage their own finances.

However, 46% of this group said that they were likely to use one in the future and a further 34% said they were unsure. Just 16% said they were unlikely to use an adviser and only 3% said they would never use one.

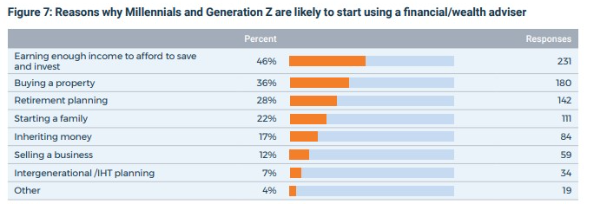

Of the respondents who said that they would use an adviser in the future, the main reason for using one would be saving and investing once they earn enough income. More than a third (36%) said they would consider using one after buying a property, while just over a quarter (28%) would use one for retirement planning.

Moreover, 56%of respondents already use an adviser, which is driven by needing help when it comes to choosing the best savings and investment vehicles, followed by retirement planning and, thirdly, intergenerational planning such as wealth transfer between parents, spouse, and children.

The study also suggested that for many millennials and generation Z, engaging with a financial adviser is a relatively recent occurrence, with the report finding that over 65% of respondents used an adviser for the first time within the last two years.

Business line director of tax Tom Mullard said: “Our report demonstrates the scale of the opportunity for advisers when it comes to targeting younger generations. For those who have already achieved significant earning power, there is a huge appetite to save and invest and indeed, for many to seek advice about how best to do this if they have not done so already.

“For those who are undecided about using a wealth manager, building relationships and ensuring they see the value of advice and the range of advice that can be given will be key to converting them into long-term clients.”

To find out how a Financial Adviser can help you, call Retirement Professionals today on 0800 098 7050 to book an appointment for a no obligation 1 hour consultation.

Sahar Nazir (Professional Advisor)