Payback period on a benchmark £100,000 annuity today is 14.5 years

Current record annuity rate levels have pulled the break-even point for holders closer by five years, latest statistics show.

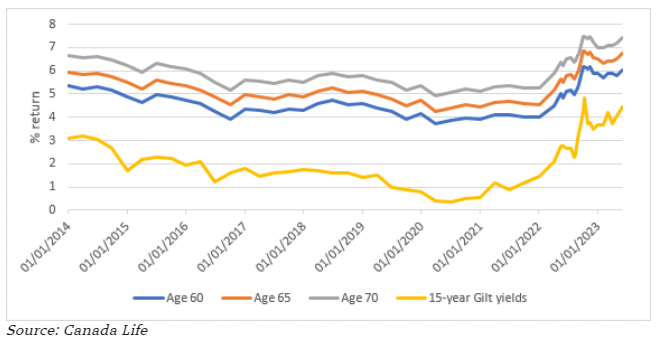

Canada Life yesterday (26 June) published figures which reconfirm the significant improvement in rates over the last 18 months.

These improvements mean the payback period on a £100,000 benchmarked annuity is currently 14.5 years, for a 65-year-old which generates an income of £6,907 a year.

An annuity holder aged 65 with no pre-existing health or lifestyle conditions is currently paying around 6.9%, Canada Life found.

Retirement income director Nick Flynn said the figures showed annuities “are firmly back in fashion”.

“Annuity rates are currently at levels not experienced since the banking crisis of 2008/09, which shows just how far we have come,” he said.

Despite this, Flynn said clients would still benefit most from a blended approach.

“Retirement choices should not be a binary decision between annuity and drawdown,” he stated. “Consider blending an annuity and drawdown to provide the best of both worlds.”

He continued: “It is difficult to predict where annuity rates will go, but markets have already priced in interest rate movements, while yields on gilts have stabilised.”

Hope William-Smith (Professional Advisor)